Investing

Asian stocks mixed as Fed cheer cools, tech hit by Nvidia’s China warning

© Reuters.

Investing.com– Asian stocks were a mixed bag on Wednesday as a recent rally- powered by easing fears of a hawkish Federal Reserve- appeared to have paused.

Technology stocks saw some losses, particularly those with exposure to NVIDIA Corporation (NASDAQ:) after the world’s most valuable chipmaker warned of a severe downturn in Chinese revenue, even after posting strong quarterly earnings.

Chinese stocks fell as a rebound from multi-year lows appeared to be running out of steam. The and indexes shed about 0.5% and 0.3%, respectively, as investors awaited more cues on stimulus measures promised by Beijing.

Hong Kong’s index was flat, as broader losses were offset by strength in internet giant Baidu Inc (HK:) (NASDAQ:). The stock surged over 5% and was the top performer on the Hang Seng, after it beat expectations for its quarterly earnings and flagged a limited impact from U.S. chip curbs against China.

Major Chinese property stocks still saw some strength, as media reports showed Beijing drafting a list of developers that were eligible for funding support.

But broader weakness in China spilled over into Australia, where the fell 0.1%. Australian stocks were also hit by warnings on inflation from Reserve Bank Governor Michele Bullock, which could herald more interest rate hikes.

Futures for India’s index pointed to a flat open.

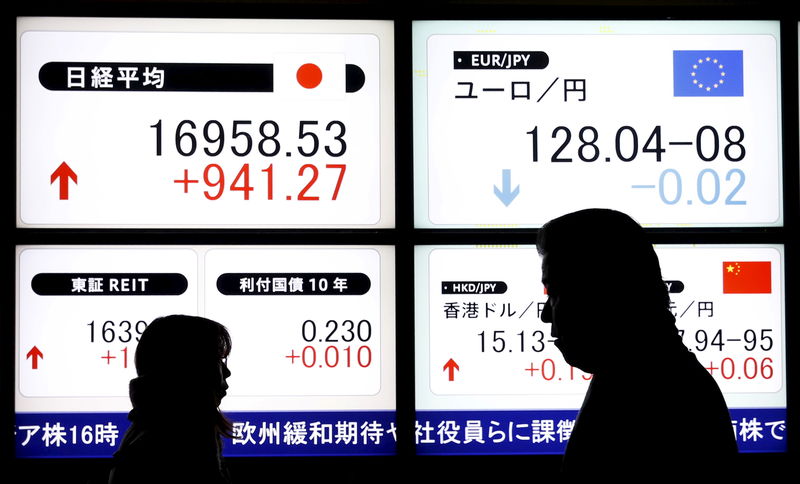

Japan’s was the sole outperformer for the day, rising 0.5% and resuming a climb back to 33-year highs. A batch of strong earnings, coupled with a dovish outlook for the Bank of Japan, were the key drivers of a stellar rally in Japanese markets this year.

The Nikkei was trading up nearly 30% so far in 2023.

Broader Asian stocks were sitting on strong gains over the past few sessions, as a slew of weak U.S. inflation and labor readings spurred bets that the Federal Reserve was done raising interest rates.

But the of the Fed’s late-October meeting, released on Tuesday, cast some doubts over this notion, given that they reiterated the Fed’s stance to keep rates higher for longer.

The minutes spurred some recovery in the dollar and Treasury yields, which in turn weighed on risk-driven assets. Technology stocks also saw some losses on this trade.

Asian tech slips as Nvidia warns of China revenue drop

Tech-heavy Asian bourses slipped on Wednesday, with Nvidia suppliers leading losses after the firm warned that its revenue from China stood to fall substantially due to U.S. curbs on chip exports to the country.

South Korea’s fell 0.3%, weighed by losses in memory chip makers SK Hynix Inc (KS:) and Samsung Electronics Co Ltd (KS:).

TSMC (TW:) (NYSE:)- a major Nvidia supplier- sank over 1% in Taiwan trade, pulling the index lower by a similar margin. In Japan, chip testing equipment maker and Nvidia supplier Advantest Corp. (TYO:) lost nearly 3%.

But most regional tech stocks were coming off recent highs, having seen a strong run-up over the past few sessions on easing Fed fears and anticipation of the Nvidia earnings. The chipmaker still , and also forecast December quarter revenue above market expectations, citing increased demand from artificial intelligence development.

Read the full article here

-

Make Money6 days ago

Make Money6 days ago10 Critical Questions to Ask Your Financial Advisor Now

-

Make Money5 days ago

Make Money5 days ago10 Ways to Make Money As a Graphic Designer

-

Personal Finance4 days ago

Personal Finance4 days agoIf you are 60 years old, new 401(k) rules could save you money

-

Investing5 days ago

Investing5 days agoCould Easier Cancellations Build Customer Loyalty?

-

Investing6 days ago

Investing6 days agoAirbus keeps top spot with 766 jet deliveries in 2024 By Reuters

-

Investing3 days ago

Investing3 days agoBank regulator gives BlackRock new deadline on bank stakes, Bloomberg reports By Reuters

-

Side Hustles5 days ago

Side Hustles5 days agoTrump’s 2025 Inaugural Committee Raises Record $170 Million

-

Side Hustles4 days ago

Side Hustles4 days ago5 AI Books Top Entrepreneurs Are Reading in a Rush for 2025