Investing

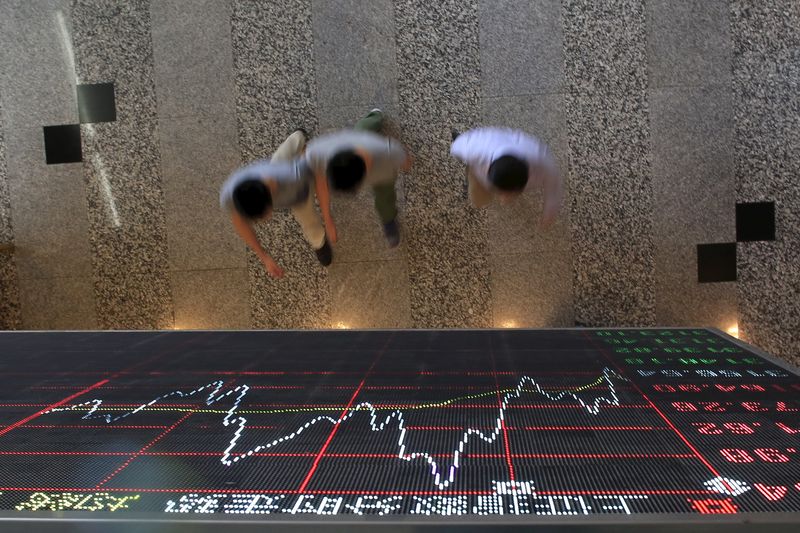

Asian stocks pull back ahead of China rate cut, Powell testimony

© Reuters.

Investing.com– Most Asian stocks moved in a flat-to-low range on Monday, with Chinese markets falling the most as investors awaited more interest rate cuts in the country, while more cues from the U.S. Federal Reserve also remained in focus.

Fed Chair Jerome Powell is set to on Wednesday, potentially offering more cues on monetary policy after the central bank paused its rate hike cycle but flagged at least two more rate hikes later in the year.

Chinese stocks slip as growth concerns build ahead of loan prime rate cut

China’s and indexes fell 0.8% and 0.5%, respectively, while Hong Kong’s index lost 0.9% as they retreated from strong gains made last week.

The People’s Bank of China is widely expected to further trim its benchmark on Tuesday, after the bank cut medium and short-term lending rates last week.

While the move triggered a strong rally in Chinese markets over the past week, they were still trading relatively lower for the year-to-date as concerns over slowing growth in the country persisted.

Goldman Sachs (NYSE:) slashed its economic growth outlook for China this week, joining a slew of other investment banks amid waning bets on an economic rebound in the country this year.

Economic readings for April and May showed that a Chinese rebound was running out of steam, despite the lifting of anti-COVID measures earlier this year.

Markets also took little support from high-level talks between U.S. and Chinese ministers, as both sides flagged little progress towards defusing strained tensions between the world’s largest economies.

Losses in China spilled over into other markets, with South Korea’s down 0.8%, while led losses across Southeast Asia with a 1% decline.

Japan’s fell 0..1%, while the broader added 0.1%, pausing after rallying to fresh 33-year highs last week.

Australia’s was among the few outperformers for the day, rising 0.7% on strength in heavyweight banking and financial stocks.

Powell testimony, Fed speakers on tap

Broader Asian markets kept to a flat-to-low range, ahead of a testimony by Fed Chair Jerome Powell before Congress on Wednesday.

Investors were on edge over any more hawkish signals on monetary policy, particularly after the Fed flagged a higher terminal interest rate this year.

Rising interest rates bode poorly for Asian markets, given that they limit foreign capital flows into the region and also diminish the appeal of risk-driven assets.

Beyond Powell, several other Fed officials are also set to talk this week.

Read the full article here

-

Passive Income7 days ago

Passive Income7 days agoJoin the Highest-Growing Industry in 2025 With This $60 Cybersecurity E-Learning Bundle

-

Side Hustles5 days ago

Side Hustles5 days agoAI Agents Are Becoming More Humanlike — and OpenAI Is Launching a New One in January. Are Entrepreneurs Ready to Embrace the Future?

-

Passive Income5 days ago

Passive Income5 days agoSending A Last-Minute Marketing Email? Follow This 7-Step Checklist to Avoid Making These Costly Mistakes

-

Investing4 days ago

Investing4 days agoMaersk asks customers to remove cargo before potential strike at US ports By Reuters

-

Investing4 days ago

Investing4 days agoCheck it Out: An AI Multi-Tool for Any Budget

-

Investing7 days ago

Investing7 days agoMorgan Stanley boosts consumer finance outlook for 2025 By Investing.com

-

Side Hustles7 days ago

Side Hustles7 days agoLooking to Sell Your Company? Here’s a Potentially Lucrative Exit Plan Every Business Needs to Consider.

-

Investing6 days ago

Investing6 days agoLifetime Digital Asset Management Made Simple for Businesses