Investing

Asian stocks rise as China stimulus hopes offset glum PMIs

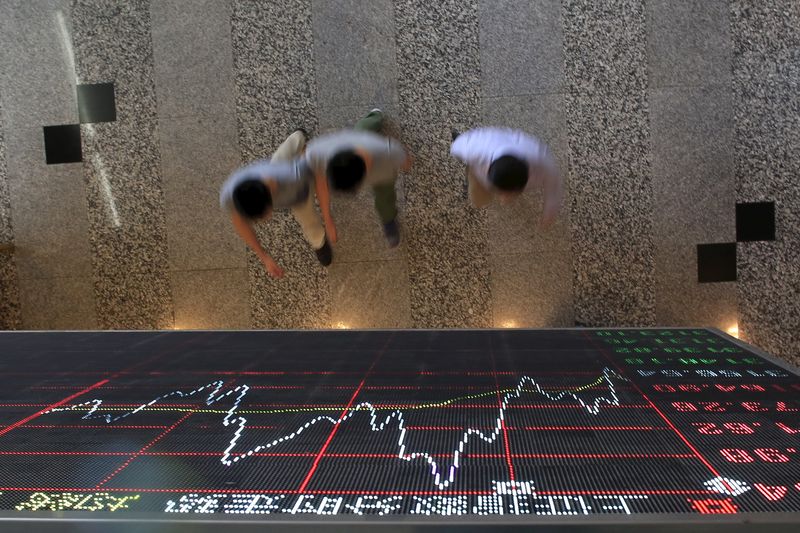

© Reuters.

Investing.com– Most Asian stocks rose on Monday, extending last week’s rally as optimism over more Chinese stimulus measures largely offset data showing business activity in the country deteriorated further in July.

Hopes of fewer U.S. interest rate hikes also aided regional markets, after data on Friday showed that the Federal Reserve’s eased in June.

Japanese stocks were the best performers in the region, rebounding sharply from losses on Friday as the Bank of Japan (BOJ) carried out an unscheduled bond-buying operation to help stem a spike in yields.

The rose 1.4%, while the broader added 1.3%, with both indexes now moving back towards their 30-year peaks. Japanese stocks rose even as data showed that grew less than expected in June, while fell.

Chinese stocks rise as stimulus bets offset weak PMIs

Chinese markets firmed on Monday as the State Council outlined more measures to boost domestic consumption and economic growth.

The Council unveiled measures aimed chiefly at increasing retail discretionary spending, as well as supporting the real estate and automobile markets.

China’s index rose 0.8%, while the added 0.6%. Gains in Chinese stocks saw Hong Kong’s index surge 1.6%, as the council also unveiled measures intended to support the country’s biggest tech companies.

But bigger gains were held back by data showing that China’s shrank for a fourth straight month in July, while also deteriorated.

The readings indicated that the Chinese economy was still struggling after a weak third quarter, and that more policy support was needed to boost Asia’s largest economy.

Other China-exposed Asian stocks advanced on Monday, with South Korea’s up 0.8%, while most Southeast Asian markets rose.

On the other hand, futures for India’s index pointed to a weak open, as investors collected profits after a string of record highs through July.

Australian stocks flat amid RBA uncertainty

Australia’s index traded sideways on Monday, as investors hunkered down before a meeting on Tuesday.

Markets are split over whether the bank will hike rates further. While inflation has recently eased in the country, it still remains well above the RBA’s 2-3% annual target.

Recent data also showed that the labor market remains strong, which could keep inflation sticky in the coming months, inviting more hikes from the central bank.

Read the full article here

-

Investing4 days ago

Investing4 days agoThis All-Access Pass to Learning Is Now $20 for Black Friday

-

Passive Income4 days ago

Passive Income4 days agoHow to Create a Routine That Balances Rest and Business Success

-

Side Hustles5 days ago

Side Hustles5 days agoApple Prepares a New AI-Powered Siri to Compete With ChatGPT

-

Side Hustles2 days ago

Side Hustles2 days agoA Macy’s Employee Made Accounting Errors Worth $132 Million

-

Side Hustles6 days ago

Side Hustles6 days agoMIT Gives Free Tuition For Families Earning $200,000 or Less

-

Passive Income5 days ago

Passive Income5 days agoCustomers Want More Than Just a Product — Here’s How to Keep Up

-

Side Hustles4 days ago

Side Hustles4 days agoGift the Power of Language Learning with This Limited-Time Price on Babbel

-

Investing1 day ago

Investing1 day agoFactbox-How Trump can overhaul US financial regulators when he takes office By Reuters