Investing

General Electric Upgrades 2023 Outlook, Plans to Spin off Aviation and Energy Divisions

© Reuters.

General Electric (NYSE:) has announced an upgrade in its 2023 outlook following robust third-quarter earnings, driven by the exceptional performance of its aviation and energy divisions. This news was shared on Tuesday, under the leadership of CEO Larry Culp Jr.

The strong Q3 results, which showed a revenue growth of 23.24% and a gross profit of 20.02B USD, according to InvestingPro data, have prompted GE to devise a strategic development plan for these high-performing sectors. As part of this strategy, the company plans to spin off its aviation and energy units into independent entities by the second quarter of 2024.

This decision is currently being scrutinized by financial analysts Seana Smith and Brad Smith from Yahoo Finance. They are closely examining the potential impact of this move on the resilience of GE’s aerospace and energy units. The analysts are particularly interested in understanding how this spin-off strategy could affect the rapid growth currently being experienced by these sectors.

InvestingPro Tips suggest that GE’s strong earnings should allow management to continue dividend payments, and the company has maintained dividend payments for 53 consecutive years. This, coupled with the fact that GE is a prominent player in the Industrial Conglomerates industry and operates with a moderate level of debt, might be a factor in the company’s decision to spin off its high-performing sectors.

This development follows a period of impressive earnings for GE, primarily attributed to the “rapid growth” of its aviation and energy divisions. The company’s decision to spin off these sectors comes as part of a broader effort to capitalize on their success and further enhance their performance as separate entities.

As the market awaits further details on GE’s strategic plan, all eyes will be on how these proposed changes could shape the future trajectory of the company’s aerospace and energy units. Investors and analysts will be keen to see how GE’s P/E ratio of 13.16, as per InvestingPro data, and the anticipated net income growth, as suggested by InvestingPro Tips, will be influenced by these strategic moves.

For more insightful information and tips, check out InvestingPro, which offers additional tips and real-time metrics that can help investors make informed decisions.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

Read the full article here

-

Side Hustles6 days ago

Side Hustles6 days agoHow to Be Unapologetically You and Why It Matters

-

Investing5 days ago

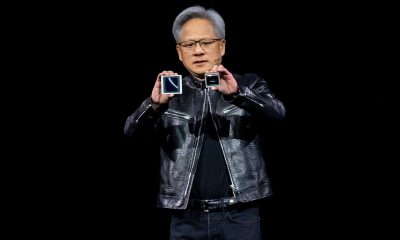

Investing5 days agoNvidia CEO Jensen Huang: Demand For Blackwell AI Is Insane

-

Side Hustles6 days ago

Side Hustles6 days agoWith AI Magicx, It’s Like Getting an Entire Creative Team in One Money-Saving AI Tool

-

Side Hustles5 days ago

Side Hustles5 days agoMark Zuckerberg Is Now Second Richest Person in the World

-

Passive Income6 days ago

Passive Income6 days agoHow AI-Driven Personalization Is Transforming the Retail Industry

-

Investing3 days ago

Investing3 days agoHurricane Helene Hits Spruce Pine Mine, Quartz Used for Tech

-

Side Hustles5 days ago

Side Hustles5 days agoMeta Previews Movie Gen, AI Tools That Turn Dreams to Videos

-

Investing5 days ago

Investing5 days agoBCA says investors should fade the real estate rally By Investing.com