Investing

JPMorgan bankers met with Epstein after his accounts were closed – WSJ

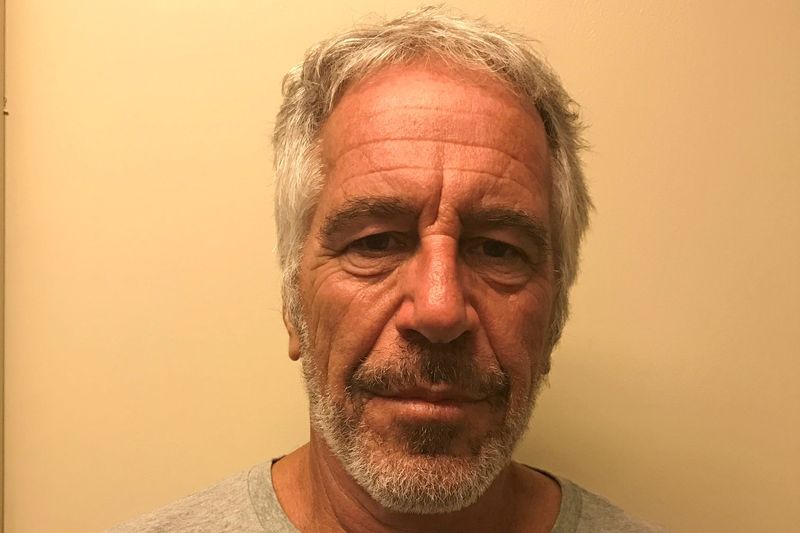

© Reuters. U.S. financier Jeffrey Epstein appears in a photograph taken for the New York State Division of Criminal Justice Services’ sex offender registry March 28, 2017 and obtained by Reuters July 10, 2019. New York State Division of Criminal Justice Services/Ha

2/2

NEW YORK (Reuters) – JPMorgan Chase & Co (NYSE:) bankers continued to have meetings with the sex offender Jeffrey Epstein even after the bank decided to close his accounts in 2013, the Wall Street Journal reported on Friday, citing people familiar with the matter.

The banker Justin Nelson had about a half-dozen meetings at Epstein’s townhouse between 2014 and 2017, the newspaper said.

Bank employees also met with Epstein after his accounts were closed to discuss other clients and introductions he could make to potential clients, the newspaper said, citing people familiar with the meetings.

Epstein, a well-connected money manager dogged for years by allegations that he sexually abused girls and young women, killed himself in a Manhattan jail cell in August 2019 while awaiting trial on sex trafficking charges.

While still a client of JPMorgan, Epstein met in 2011 and 2013 with Mary Erdoes, who is now CEO of the bank’s asset and wealth management unit, and in 2013 with John Duffy, who ran JPMorgan’s U.S. private bank, the newspaper said.

JPMorgan has denied knowledge of Epstein’s crimes and is suing former executive Jes Staley for misleading it about Epstein’s conduct.

The interaction with Epstein was typical for a client of the private bank, a JPMorgan spokesman said after the article was published.

Erdoes’ first meeting with Epstein involved settling a lawsuit he had filed against Bear Stearns, and any of the bank’s meetings with Epstein after 2013 were requested by clients who used Epstein as an adviser, the spokesman said. JPMorgan bought Bear during the 2008 financial crisis.

Nelson declined to comment via the spokesman. Duffy and Staley’s lawyers did not reply immediately to separate requests for comment.

JPMorgan is being sued in Manhattan federal court by women who said Epstein sexually abused them, and by the government of the U.S. Virgin Islands, where Epstein owned a private island.

JPMorgan did business with Epstein as early as 1998, and managed about 55 Epstein-related accounts worth hundreds of millions of dollars.

According to court papers, compliance staff and executives on several occasions flagged the risks of keeping Epstein as a client, including his alleged use of cash to pay for girls and young women to go to his homes.

Epstein was a client for about five years after he pleaded guilty in 2008 to a Florida state prostitution charge.

Read the full article here

-

Investing4 days ago

Investing4 days agoThis All-Access Pass to Learning Is Now $20 for Black Friday

-

Passive Income4 days ago

Passive Income4 days agoHow to Create a Routine That Balances Rest and Business Success

-

Side Hustles5 days ago

Side Hustles5 days agoApple Prepares a New AI-Powered Siri to Compete With ChatGPT

-

Side Hustles2 days ago

Side Hustles2 days agoA Macy’s Employee Made Accounting Errors Worth $132 Million

-

Side Hustles6 days ago

Side Hustles6 days agoMIT Gives Free Tuition For Families Earning $200,000 or Less

-

Passive Income5 days ago

Passive Income5 days agoCustomers Want More Than Just a Product — Here’s How to Keep Up

-

Side Hustles4 days ago

Side Hustles4 days agoGift the Power of Language Learning with This Limited-Time Price on Babbel

-

Investing1 day ago

Investing1 day agoFactbox-How Trump can overhaul US financial regulators when he takes office By Reuters