Personal Finance

Are Index Funds Actually Bad for Investors?

***Money is not a client of any investment adviser featured on this page. The information provided on this page is for educational purposes only and is not intended as investment advice. Money does not offer advisory services.***

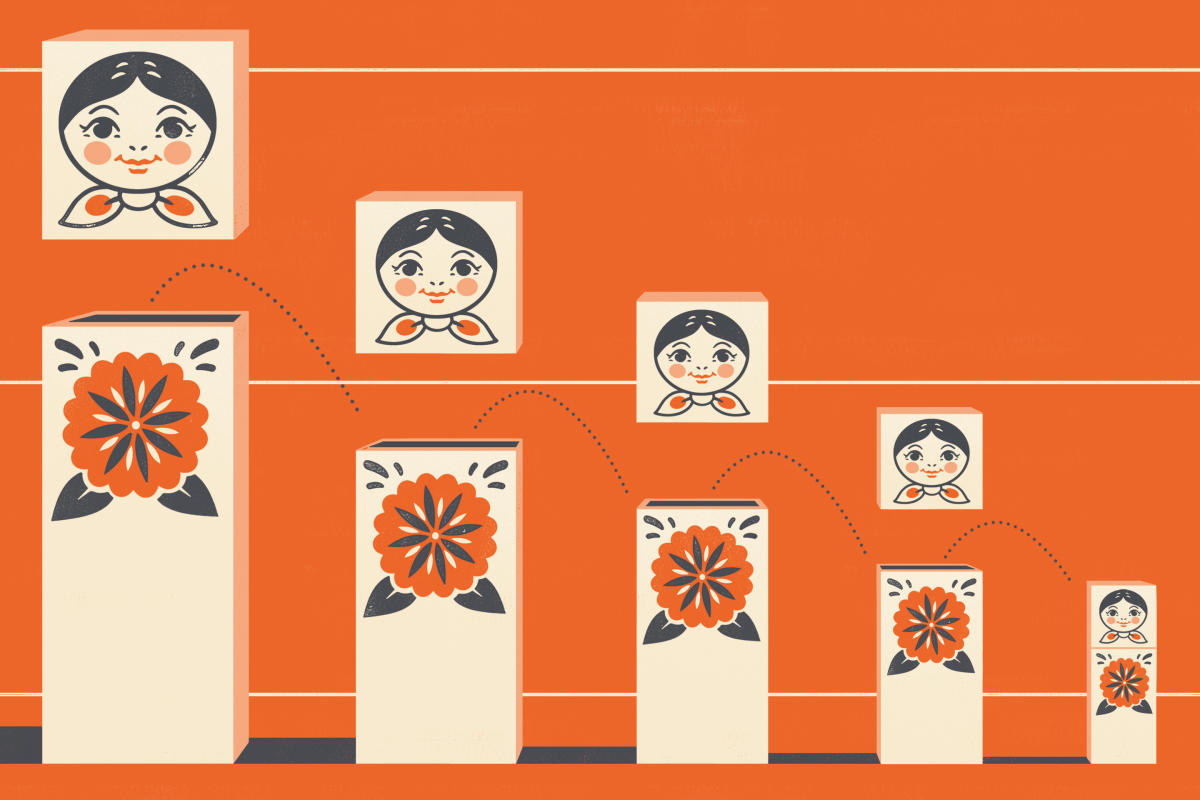

Since its creation more than four decades ago, one market invention has become a go-to for many everyday investors: the index fund. But recent research shows that index funds’ popularity might actually reduce returns for investors over the long term.

Index funds are designed to mimic the performance of a specific market index, like the S&P 500 or the Dow Jones Industrial Average. They can allow the average person to invest widely across the entire stock market with a relatively small amount of risk compared to picking stocks individually.

Researchers from the University of Oxford and the University of California, Los Angeles recently built a model that shows what happens to stock prices and investor welfare as index funds become cheaper and more popular. They’re certainly not telling you to give up on index funds — which can provide a strong foundation for your investment portfolio — but the results do provide insight into a lesser-known effect the rush to index funds could be having on investors.

Index fund performance

Index funds tend to outperform products in which professionals are selecting where to invest the fund’s money, like actively managed mutual funds and exchange-traded funds (ETFs), over the long run. Data from S&P Indices shows that over the past 15 years, only 6.6% of actively managed large-cap funds outperformed the S&P 500, which is an index commonly used to measure how U.S. stocks overall are performing. Take the Vanguard 500 Index Fund: Over the past ten years, investors in this fund have earned 12.2% annually.

In addition to their less impressive performance, actively managed funds often have significantly higher fees, too.

It’s no wonder that index funds are only getting more popular. So what’s the downside?

Why index funds may hurt investors in the long run

Index funds can provide investors with diversification across companies of various industries and sizes, and even invest across the entire stock market.

As a result, they make moving from a relatively less risky assets like bonds to riskier assets like stocks more tolerable for everyday investors, William Zame, the Jack Hirshleifer Professor of Economics at the University of California, Los Angeles, and one of the study’s authors, tells Money. (Higher risk investments often offer the possibility of higher returns).

As index funds become cheaper and more widely available (as they have for the last four decades), more investors are able to participate in the stock market and take advantage of those higher returns — but there’s a cost.

“As everybody is moving money from bonds into stocks, the price of stocks go up,” Zame says.

That’s a bad thing for investors, he adds: When prices rise but the fundamentals of companies don’t change, expected returns fall. That’s because individual investors end up paying more for a stock whose underlying worth (in terms of corporate earnings) hasn’t changed. The losses get bigger the more index funds reduce their fees, since lower fees attract even more investors to the market.

As a result, the researchers wrote, “few — if any — investors benefit from the availability of cheap market indexing.” And what’s more, the researchers concluded, the market returns that everyday investors do earn from investing in index funds are lower than the returns they would get from the market if index funds didn’t exist at all.

In short, Zame says the results show that the traditional advice about index funds is misleading because it omits the fact that large numbers of investors in index funds can drive up stock prices and reduce returns for everyone.

Should you still buy index funds?

While the popularity of index funds may hurt their potential over the long term, you shouldn’t throw them out the window.

Index funds are still the right choice for many investors, despite the potential harm to the universe of investors as a whole, because they still offer very real benefits to individual investors, Zame says.

He also recommends investing in other products, like bonds, in addition to index funds “depending on how much money you have and what your risk attitude toward risk is.” That’s part of building a diversified portfolio.

At the end of the day, index funds are still an important part of a balanced investment portfolio, and the results of the study don’t negate their benefits: low fees, diversification and decent returns over the long term. But it’s good to keep in mind that sometimes the investing advice you receive may not always capture the whole picture.

More from Money:

How to Invest in Index Funds

Own an Index Fund? You’re Making a Big Bet on Tech

Direct Indexing: Pros and Cons of the Latest Investing Strategy to Go Mainstream

© Copyright 2023 Money Group, LLC. All Rights Reserved.

This article originally appeared on Money.com and may contain affiliate links for which Money receives compensation. Opinions expressed in this article are the author’s alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. Offers may be subject to change without notice. For more information, read Money’s full disclaimer.

Read the full article here

-

Side Hustles6 days ago

Side Hustles6 days agoKickstart Your Year With These Entrepreneurial Health Checkups

-

Side Hustles5 days ago

Side Hustles5 days agoExpand Your Global Reach with Access to More Than 150 Languages for Life

-

Side Hustles4 days ago

Side Hustles4 days agoKFC Announces Saucy, a Chicken Tenders-Focused Spinoff

-

Side Hustles5 days ago

Side Hustles5 days agoThis AI is the Key to Unlocking Explosive Sales Growth in 2025

-

Investing4 days ago

Investing4 days agoPalantir, Anduril join forces with tech groups to bid for Pentagon contracts, FT reports By Reuters

-

Side Hustles3 days ago

Side Hustles3 days ago4 Ways Content Can Make or Break the Customer Experience

-

Passive Income7 days ago

Passive Income7 days ago5 Key Success Factors of Thriving Entrepreneurs

-

Passive Income6 days ago

Passive Income6 days agoHow to Motivate, Inspire and Energize Your Employees