Personal Finance

Today’s best mortgage deal? 10- and 15-year terms hit lowest rates | April 6, 2023

Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as “Credible” below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own.

Based on data compiled by Credible, mortgage rates for home purchases have risen for two key terms, remained stable for one term, and fallen for another term since yesterday.

Rates last updated on April 6, 2023. These rates are based on the assumptions shown here. Actual rates may vary. Credible, a personal finance marketplace, has 5,000 Trustpilot reviews with an average star rating of 4.7 (out of a possible 5.0).

What this means: Mortgage rates have begun to climb back to 6% for 30-year rates with 20-year rates not far behind. Twenty-year rates have jumped a quarter of a percentage point to 5.875%. Ten-year rates have fallen to join 15-year rates at 5.125%. Homebuyers looking to maximize their savings should consider either short-term payment plan, as they’re today’s lowest rate. Borrowers who would prefer a smaller monthly payment should consider 20-year rates before they rise above 6%.

To find great mortgage rates, start by using Credible’s secured website, which can show you current mortgage rates from multiple lenders without affecting your credit score. You can also use Credible’s mortgage calculator to estimate your monthly mortgage payments.

Based on data compiled by Credible, mortgage refinance rates have fallen across all key terms since yesterday.

Rates last updated on April 6, 2023. These rates are based on the assumptions shown here. Actual rates may vary. With 5,000 reviews, Credible maintains an “excellent” Trustpilot score.

What this means: Mortgage refinance rates have fallen by a quarter of a percentage point across all key terms. Both short-term payment plans have hit their lowest rate since February with 10-year rates at 5.000% and 15-year rates hitting today’s lowest at 4.99%. Thirty-year terms have also hit their lowest rate since February at 5.625%, while 20-year rates haven’t been this low since August. Homeowners looking for a smaller monthly payment should consider 20-year rates at 5.375%, as they’re a quarter of a percentage point lower than 30-year rates.

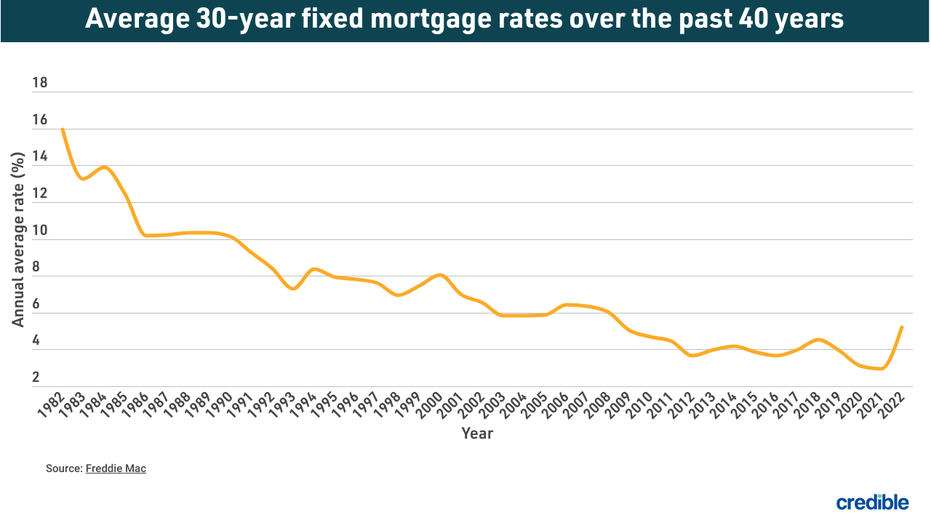

How mortgage rates have changed over time

Today’s mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac – 16.63% in 1981. A year before the COVID-19 pandemic upended economies across the world, the average interest rate for a 30-year fixed-rate mortgage for 2019 was 3.94%. The average rate for 2021 was 2.96%, the lowest annual average in 30 years.

The historic drop in interest rates means homeowners who have mortgages from 2019 and older could potentially realize significant interest savings by refinancing with one of today’s lower interest rates. When considering a mortgage or refinance, it’s important to take into account closing costs such as appraisal, application, origination and attorney’s fees. These factors, in addition to the interest rate and loan amount, all contribute to the cost of a mortgage.

How Credible mortgage rates are calculated

Changing economic conditions, central bank policy decisions, investor sentiment and other factors influence the movement of mortgage rates. Credible average mortgage rates and mortgage refinance rates reported in this article are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 700 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no (or very low) discount points and a down payment of 20%.

Credible mortgage rates reported here will only give you an idea of current average rates. The rate you actually receive can vary based on a number of factors.

Factors that influence mortgage rates (and are out of your control)

Many factors influence the interest rate a lender may offer you. Some – such as your credit score – are in your control. But others you have no ability to affect, such as:

- The economy — During financial downturns, the Fed may lower interest rates to try to stimulate the economy. And when the economy is doing well, interest rates can rise.

- Inflation — Interest rates tend to move with inflation. When the overall cost of goods and services increases, interest rates are also likely to rise.

- The Federal Reserve — The Fed may choose to lower interest rates to stimulate a struggling economy, or raise rates in an attempt to put the brakes on inflation.

- Macro employment trends — When many people are out of work, as they were during the months of pandemic lockdown, mortgage rates may fall. As employment increases, interest rates typically also increase.

If you’re trying to find the right mortgage rate, consider using Credible. You can use Credible’s free online tool to easily compare multiple lenders and see prequalified rates in just a few minutes.

Have a finance-related question, but don’t know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.

Read the full article here

-

Side Hustles6 days ago

Side Hustles6 days agoKickstart Your Year With These Entrepreneurial Health Checkups

-

Side Hustles5 days ago

Side Hustles5 days agoExpand Your Global Reach with Access to More Than 150 Languages for Life

-

Side Hustles4 days ago

Side Hustles4 days agoKFC Announces Saucy, a Chicken Tenders-Focused Spinoff

-

Side Hustles5 days ago

Side Hustles5 days agoThis AI is the Key to Unlocking Explosive Sales Growth in 2025

-

Investing4 days ago

Investing4 days agoPalantir, Anduril join forces with tech groups to bid for Pentagon contracts, FT reports By Reuters

-

Side Hustles3 days ago

Side Hustles3 days ago4 Ways Content Can Make or Break the Customer Experience

-

Passive Income7 days ago

Passive Income7 days ago5 Key Success Factors of Thriving Entrepreneurs

-

Passive Income6 days ago

Passive Income6 days agoHow to Motivate, Inspire and Energize Your Employees